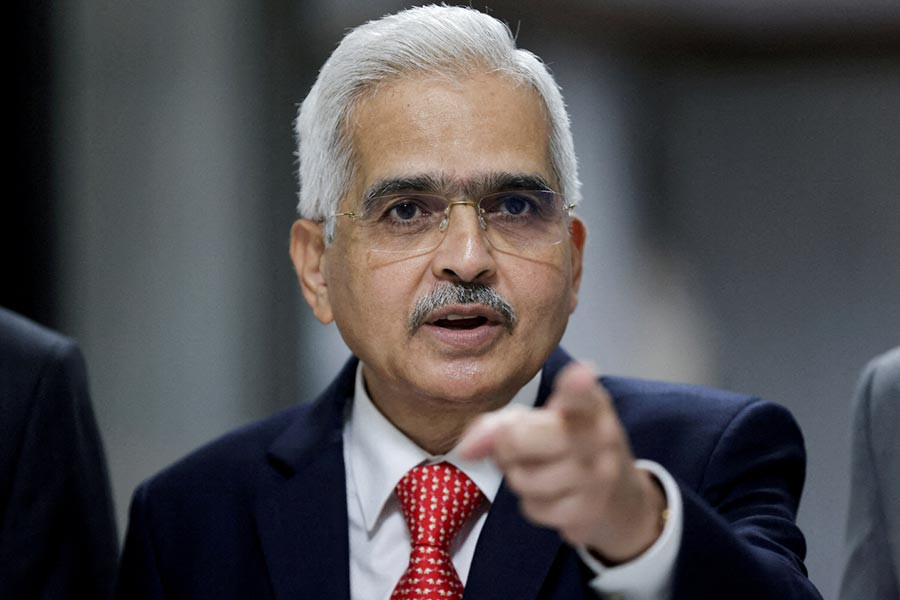

There will be no extra interest burden, RBI Keeps Repo Rate Steady at 6.5% in a Pragmatic Move

Mumbai [8th June 2023]: In a highly anticipated monetary policy review, the Reserve Bank of India (RBI) has announced its decision to maintain the repo rate at 6.5%. The move comes amidst a backdrop of economic uncertainties and is seen as a pragmatic approach to strike a delicate balance between supporting economic recovery and managing inflationary pressures.

The RBI's decision to keep the repo rate unchanged reflects

its cautious stance in the face of evolving economic conditions. Despite calls

for a rate cut to stimulate growth, the central bank has opted to prioritize

its objective of containing inflation, which has been on the rise in recent

months.

The repo rate serves as the benchmark interest rate at which

commercial banks borrow from the RBI, influencing lending rates across the

economy. By keeping the rate steady, the RBI signals its commitment to

maintaining stability in the financial markets while recognizing the need to

nurture economic growth.

The decision takes into account various factors shaping the

overall economic landscape. Globally, uncertainties and trade tensions continue

to prevail, warranting a cautious approach. Domestically, the economy grapples

with the aftermath of the COVID-19 pandemic, supply chain disruptions, and

escalating commodity prices, all contributing to inflationary pressures.

Amidst these challenges, the RBI's pragmatic stance of

keeping the repo rate unchanged aims to strike a balance between bolstering

economic recovery and curbing inflation. Lowering interest rates could

potentially exacerbate inflationary pressures in the short term, hence the

cautious approach.

Moreover, the RBI's decision is rooted in its commitment to

ensuring stability and resilience in the banking sector. By maintaining the

repo rate, the central bank ensures that financial institutions have the

necessary stability and liquidity to navigate these uncertain times.

Looking ahead, the RBI will closely monitor evolving

economic conditions and take appropriate measures as needed. While the repo

rate remains unchanged for now, future decisions will be guided by the central

bank's mandate of achieving a delicate equilibrium between growth and

inflation.

You might also like!