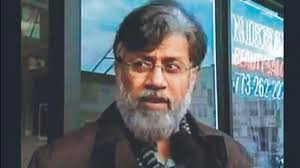

Navigating Market Volatility: Nilesh Shah's Strategic Sector Picks for Smart Investing

IIE DIEITAL DESK :In an era marked by economic uncertainties and fluctuating markets, investors are seeking guidance to make informed decisions. Nilesh Shah, Managing Director of Kotak Mahindra Asset Management Company, offers a sectoral outlook to navigate these challenging times.

Shah emphasizes the potential of domestic-focused industries. He notes that consumers now have more disposable income due to tax cuts and government initiatives, which is likely to boost sectors such as consumer goods, infrastructure, and financial services. These areas are less exposed to global economic tensions and may offer more stable returns.

The Indian economy is experiencing a significant capital expenditure cycle, driven by both government and corporate investments. This surge has led to a notable increase in corporate orders, reaching levels last observed in 2017. Sectors benefiting from this revival include semiconductor manufacturing, electronic manufacturing services, and defense. Aerospace and space technology companies are also gaining momentum due to their engineering and manufacturing capabilities.

The financial services sector presents diverse opportunities. The narrowing gap between bank credit growth and deposit growth could ease margin pressures. Both public and private sector banks have shown healthy return ratios and improved capital adequacy levels, reducing the need for fresh capital. Valuations in this sector are reasonable compared to the broader market, suggesting potential for growth.

The healthcare and pharmaceutical sectors have demonstrated resilience amid market volatility. Mutual funds focused on these areas have delivered strong one-year returns, driven by domestic and export growth, easing pricing concerns, and favorable currency movements. However, investors should remain cautious of potential future tariffs that could impact profitability, particularly for export-dependent companies.

Shah advises caution in sectors where valuations have become stretched due to rapid price increases and low floating stock. He suggests a selective approach, focusing on companies with strong fundamentals and reasonable valuations.

In the current economic landscape, strategic sector selection is crucial for investors aiming to navigate market volatility. By focusing on domestic-oriented industries, capitalizing on the capex cycle, and considering opportunities in financial services and healthcare, investors can position themselves for potential growth. However, a prudent approach is essential, emphasizing quality and valuation to mitigate risks associated with overvalued sectors.

You might also like!