2 years ago

RBI Governor Cautions Bank Boards Regarding Excessive Growth and Evergreening Practices

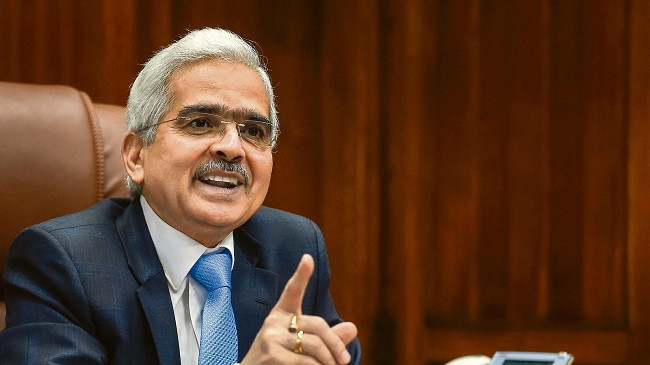

Shaktikanta Das(File Picture)

New Delhi, May 29, 2023 : The Governor of the Reserve Bank of India (RBI) has issued a warning to bank boards, urging them to exercise caution in pursuing overly aggressive growth strategies and engaging in evergreening practices. In an effort to maintain financial stability and uphold the integrity of the banking sector, the central bank emphasized the need for prudence and responsible lending.

Expressing concern over the potential risks associated with indiscriminate growth, the RBI Governor underscored the importance of maintaining a healthy balance between growth objectives and risk management. The central bank stressed the need for banks to prioritize long-term sustainability and profitability, rather than pursuing short-term gains at the expense of financial stability.

Furthermore, the RBI cautioned against the practice of evergreening, which involves granting additional credit or rolling over existing loans to borrowers who are already facing financial difficulties. Such practices, if unchecked, can lead to the accumulation of non-performing assets (NPAs) and undermine the overall health of the banking system.

The Governor urged bank boards to proactively monitor their loan portfolios and take appropriate measures to mitigate risks. This includes conducting thorough due diligence, implementing robust credit appraisal systems, and maintaining effective internal control mechanisms.

In line with its supervisory role, the RBI reiterated its commitment to maintaining a strong regulatory framework and ensuring that banks adhere to prudential norms. The central bank will continue to closely monitor the financial sector and take necessary actions to safeguard the interests of depositors and promote a stable banking environment.

It is important for banks to heed the RBI's cautionary message and adopt a balanced approach to growth, focusing on sustainable practices and risk management. By maintaining financial stability and adhering to regulatory guidelines, the banking sector can contribute to the overall economic well-being of the country.